Gain Access to Private Deals with Leading Industry Experts

Once only available to institutions and the ultra wealthy, you can now access lucrative private equity and real estate deals through a high-caliber investment firm.

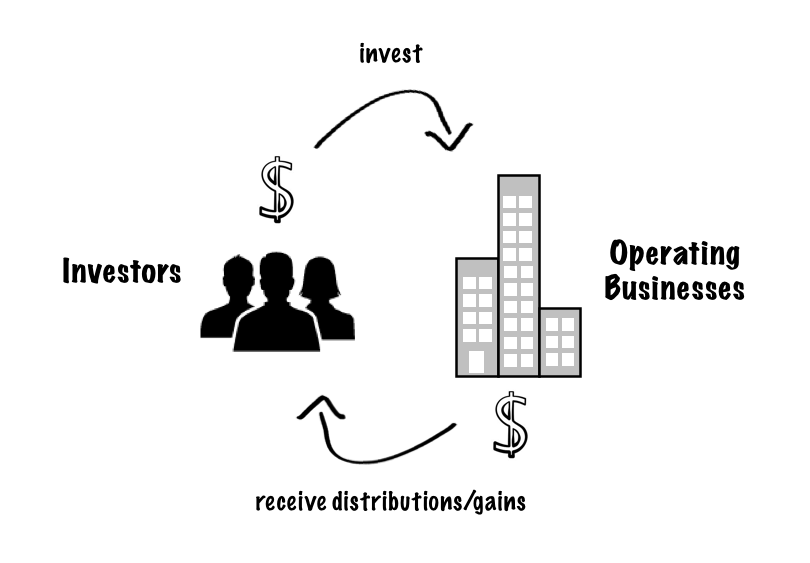

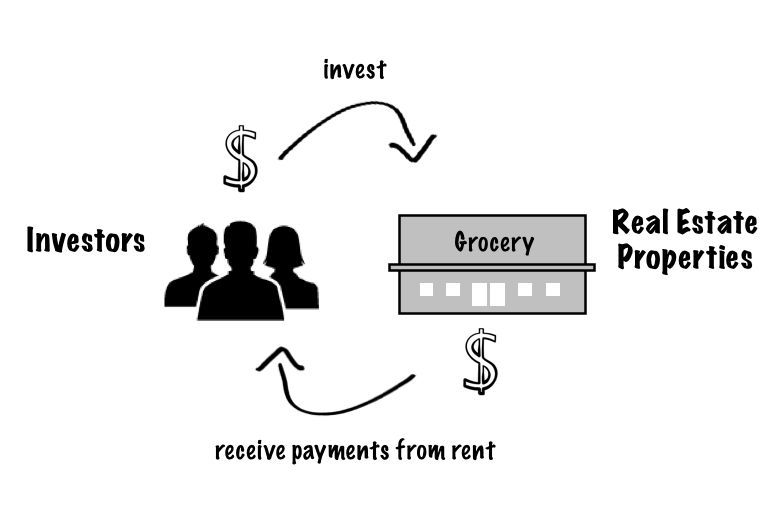

Through Blue Springs Capital’s small buyout opportunities and proprietary real estate deals, you can achieve greater diversification and returns by adding a new alternative investment to your portfolio. Blue Springs invests in primarily two types of investments:

1. Small-Medium Sized Company Buyouts

We acquire and grow stable, cash-flowing businesses that are in the $2MM to $25MM value range. We see an enormous opportunity in this part of the market because most large private equity groups cannot buy companies that small – they have to buy larger companies due to the large dollar amounts in their funds. These private equity firms are all trying to buy companies in the same size range, which causes the price of these companies to be bid up to high valuations, making it more difficult to get higher returns. On the other side of the spectrum there are many small business buyers, but they can only afford to purchase very small businesses ($150k-$1mm).

This is why we focused on the untapped market of great companies that aren’t getting attention. Also, these companies are on the cusp of being large companies, but they lack the management teams and systems to grow to the next step. You can invest in companies that have yet to reach their full potential and are not sought out by other sources of capital. Investors in these opportunities typically expect returns of 15% to 30% annually.

2. Attractive Real Estate Income Opportunities

We identify and acquire strong-tenant, cash-flowing real estate properties that create current income for investors and have the opportunity to create capital appreciation when the property is sold. Some of the property types may include office buildings, retail properties and healthcare properties. Investors in these opportunities typically expect returns of 6% to 12%.

Benefit from a team of successful entrepreneurs, experienced executives and industry experts when making an investment.

Our team of advisors and management team provide a wealth of knowledge from a wide array of industries. We like to invest in companies where one or several of our team members have experience in investing, managing or growing businesses in that particular industry. Likewise our team and network of professionals provides us with proprietary investments that no one else has access to. We take an active role in improving our investments; we don’t sit on the sidelines. We believe careful and active involvement are essential to growing the businesses we acquire.

You may be missing out on an important piece of a diversified portfolio.

Alternative investments are an important piece to a truly diversified portfolio. Many investors as of late have come to understand the power of adding alternatives to their portfolios. In addition to stocks and bonds, investors can access less correlated assets that perform differently than stocks and bonds. Many common alternative investments can include real estate, oil & gas partnerships and managed futures. But what if you are missing out on an important alternative?

For years institutional investors have invested in private equity as an important component of their portfolios. Simply put, private equity is investing in private companies – something that you cannot typically get with the stock market. On average, private equity returns outperform the stock market by 2%-4% every year¹. However, the investments are less liquid than the stock market and usually are held for 3-10 years.

Private equity allows individuals (accredited investors) to invest in the growth of the economy. In the U.S., small and medium-sized companies provide vast majority of new jobs and GDP growth. A study done by the National Center for the Middle Market showed that during the recession big companies lost 3.7 million jobs during the recession while middle market firms added 2.2 million².

Whether you want income from your investments or are focused on growth through stable businesses, we have an alternative for you. Income or Growth, we provide both.

*To participate, you must be an accredited investor ($200,000 in annual income or $1,000,000 in net worth). This is not an offer or solicitation. Purchase of securities can only be made through a prospectus and investors are advised to consult with a financial professional. As with all investments, there is a risk of partial or total loss of principal investment.

¹ Preqin.com “Private Equity Performance vs. S&P 500 – February 2013″

²http://smallbusiness.foxbusiness.com/entrepreneurs/2012/04/26/mid-size-companies-lead-way-in-growth-and-jobs/